LAS VEGAS — If voters on Tuesday approve the six-year, $0.212 property-tax hike sought by the Clark County School District, they’ll also be opening the door to a possible 30-year lifespan for the new, higher tax rate.

CCSD officials want the tax hike for capital programs. If passed, the new tax will raise school district property-tax levies from $1.3034 per $100,000 assessed valuation to $1.5154.

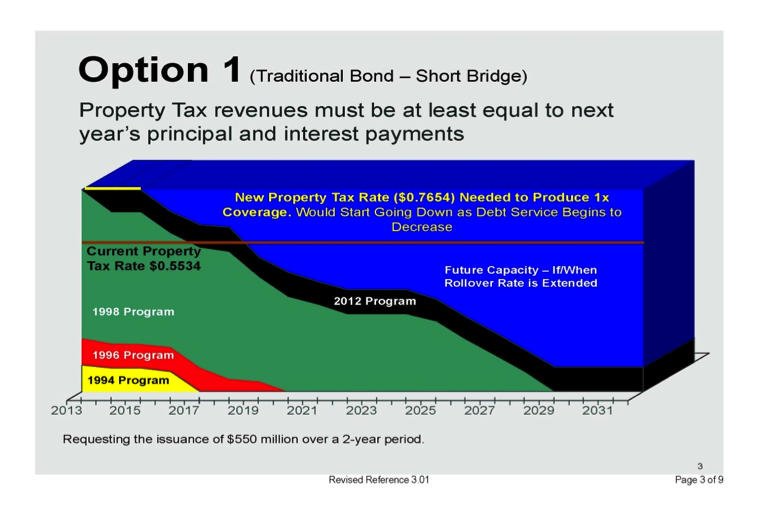

Currently, property owners are assessed $0.75 per $100,000 of assessed valuation for CCSD general operations such as salaries, and $0.5534 for capital debt-service, more commonly referred to as the 1998 bond program. If voters approve the new tax Tuesday, property owners will be assessed $0.7654 for capital debt-service.

This “bridge,” as the new tax is commonly referred to by school district officials, is said to be a six-year, pay-as-you-go plan, expected to raise $669 million to $720 million for capital projects, including two new schools, four new gymnasiums, various modernizations and land acquisitions.

Not widely known, however, is that school board trustees have the option — at any time during those six years — of going to voters and asking to have the tax rolled over into a traditional 10-year bond program, under which the district would be authorized to issue bonds for 10 years without voter approval.

The increased $0.7654 tax rate would continue until the debt was paid.

Last April, then-trustee John Cole asked the district’s hired bond counsel, “Would there be an option… to flip out of a bridge like this and to flip into a normal bond structure?”

“Yes, you could,” advised John Swendseid of the law firm Sherman & Howard. “At any time that you desire, you could put a question on the ballot for a rollover.

“And if the voters approve a rollover for a traditional bond issue like” the 1998 issue, continued Swendseid, “you can decide to discontinue the bridge and go with the rollover ….”

Such a rollover would not be unprecedented. In fact, the current $0.5534 tax-rate is a rollover.

According to Jeff Weiler, chief financial officer for CCSD, a rollover in the next six years would be very similar to what was done in 1996, when voters last raised the tax rate to $0.5534.

In that instance, the school district had sought a tax-rate increase for a two-year bond program. Then, in what Weiler characterized as “part two,” the school board came back in 1998 and asked voters to roll over the new increased rate for a 10-year bonding program. CCSD financial reports indicate that taxpayers will be repaying the current outstanding general obligation bonds through 2028.

Projections by CCSD this past April show no bonding capacity for the district until 2018 under the current $0.5534 tax rate.

However, if the district’s current tax-increase initiative is approved by voters Tuesday, the district could repeat its 1996 ploy and come back to the voters again, asking for a 10-year bond program and rollover of the new, higher rate of $0.7654. That, CCSD estimates, would generate an additional $3.7 billion to $5.1 billion in liability for taxpayers.

During the six years of the “bridge” funding, CCSD would have three general-election opportunities to seek a rollover of the tax increase.

This chart — presented by CCSD CFO Jeff Weiler to the school board April 26 — illustrates projected district bonding capacity under both the current .5534 tax rate and the proposed .7654 rate. Because the board opted for a pay-as-you-go program, the 2012 bond program reflected in black should be considered blue and interpreted as bond capacity.

Karen Gray is a reporter/researcher with Nevada Journal. For more visit https://nevadajournal.com and http://npri.org.